What is a B2B payment?

Business-to-Business payments are monetary transactions between two legal entities that do business with each other. As far as you remember, a B2C company sells goods or services to the end user. While B2B payments are related to purchases, wholesale sales, and the provision of services between organizations.

The main characteristics of B2B payments:

1. High transaction costs: Unlike consumer payments, B2B transactions often involve large amounts as companies purchase goods and services in bulk. Therefore, one mistake can be costly.

2. Complicated payment terms: companies regularly negotiate payment with a delay of 30, 60 or 90 days. This is rarely seen in ordinary transactions.

3. A variety of payment methods: bank transfers, electronic transfers, corporate credit cards, bills of exchange, letters of credit and digital payment platforms.

4. Security and compliance requirements: When it comes to payment, data security must be paramount. Especially for companies that have millions of dollars in their accounts. Therefore, there are PCI DSS and KYC standards and anti-money laundering (AML) policies for B2B transactions.

5. Complex checks and approval: in a company, as a rule, several people or departments (finance department, purchasing department, managers) confirm payments.

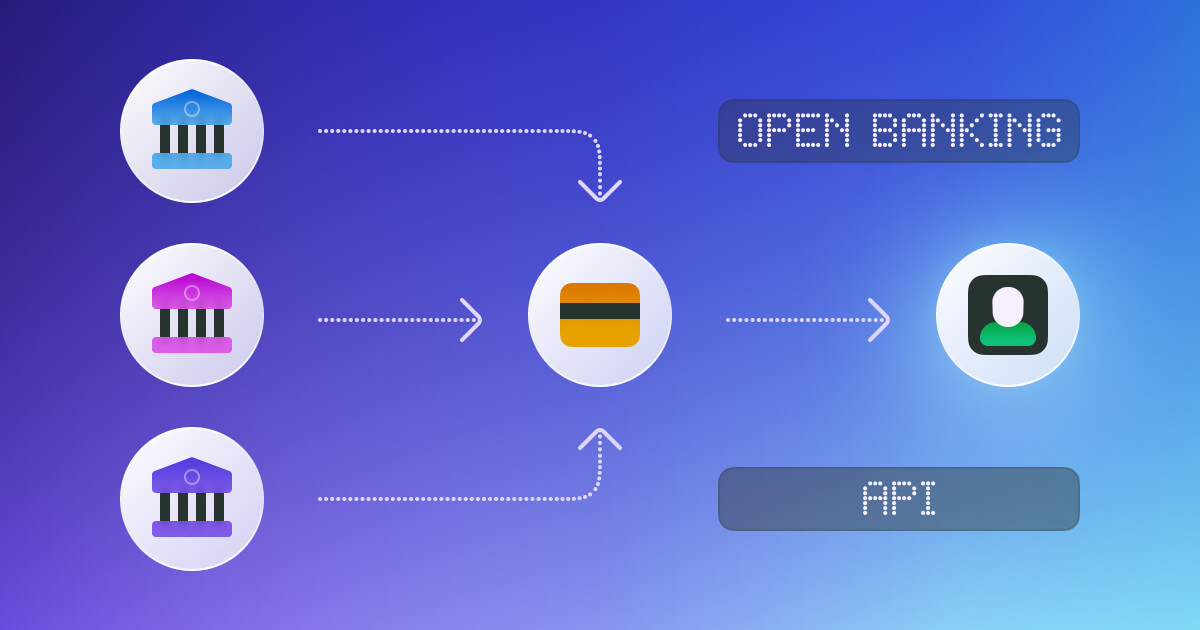

Among B2B payments, there are various types that are most typically used by legal entities. And, of course, in the first place — direct bank transfers. The method is reliable, proven for decades. However, it takes several days, especially if the money needs to be transferred abroad.

ACH (Automated Clearing House) is an electronic transfer system used in the United States for regular non—cash payments between banks. Another popular way to make a payment in the B2B sector, but it can also take several days. And business does not tolerate delays.

Letters of credit are an agreement between the buyer and the bank, which guarantees payment if certain conditions are met. If you have a risky trade, this method will definitely suit you.

Specialized B2B payment software (PayPal, Stripe etc.) allow companies to process payments quickly and securely. These systems are especially useful for small and medium-sized companies, as they offer automation and integration with accounting programs.

What is B2B payment processing?

Payment processing is the algorithm required to complete a transaction. The steps may vary depending on the specific method and type of transaction, but in general they include:

- data entry;

- identity authentication;

- verification of information;

- confirmation or rejection of the payment.

Each stage plays an important role in ensuring the reliability and security of the process, as well as ensuring that the transaction is executed correctly.

B2B payment processing is the processing of transactions that are made between companies as part of their business relationships. Such operations require more complex checks and a high level of authentication. All this is necessary to ensure data protection and prevent the risks associated with large corporate payments.

How to use payment processing for B2B e-commerce sales?

B2B e-commerce has its own characteristics that are significant to consider during payment processing. And if you don't take care of it, then who else? Therefore, we have prepared a simple step-by-step action plan for using payment processing for sales in B2B e-commerce:

1. Select a payment provider

For B2B payments, you should choose a provider that understands the specifics of B2B transactions. The provider must have flexible payment methods, support large transactions, integrate with your CRM system and protect your data.

Catalog of popular providers for B2B are on our website, where you can pick the right option for your business. If you are the payment provider itself, you can become a partner of PayAtlas now!

2. Select the appropriate payment methods

These can be bank transfers, ACH payments, corporate credit cards, digital platforms and e-wallets.

3. Integrate the payment system with your e-commerce platform

It will make your life amazingly easier! You will be able to automatically process orders and issue invoices, receive payment status notifications, synchronize data and analyze customer behavior.

4. Make sure that you have set up a multi-level security system

No one wants their payment details to be made public. Especially when it comes to companies. Make sure that the platform you have chosen provides multi-level protection for your data.

5. Check if international payments and currencies are supported

Even if you are not working with international clients yet, we wish you that! And when that happens, you will definitely need support for multi-currency payments and international security standards.

How to prevent b2b payment fraud?

While we are only thinking about security and are afraid of scammers, payment systems have already taken care of protection! And to make it easier for you to sleep, we will tell you about their findings.

1. Multifactor Authentication (MFA)

This level of protection requires not only to enter a password, but also to confirm your identity via phone, email, app, SMS or PIN code.

2. KYC (Know Your Customer)

The system checks the data of the company that wants to make a payment with you, its credit history, employees responsible for decision-making, etc.

3. Secure payment gateways

They encrypt data and comply with PCI DSS (Payment Card Industry Data Security Standard) standards. By the way, we write an article “what is a payment gateway” on our website — check now!

4. Anti-fraud monitoring

The system automatically tracks all transactions and identifies suspicious ones. For example, payment from an unknown country, many authorization attempts, or atypical amounts. It's suspicious, isn't it?

5. Separation of powers

When everyone in the company has access to your payment information, the risk is very high. Therefore, we recommend limiting the number of employees. For example, some employees can only initiate transactions, while others can approve them.

6. Tokenization

A new way to secure company data is to convert the account number into a unique token. How will this help? It cannot be used outside the system.

In order not to get hooked by scammers, you need to think about it in advance. And it's good that the payment systems have already taken care of this. All you have to do is choose the option that suits you and get started!

Comments