Find the right PSP for your business needs

Created to solve problems

Find your perfect payment provider with expert assistance

Get started with Assist

Get started with Assist

For every business type & scale

Your requests matched every time

Careful analysis

Only verified providers

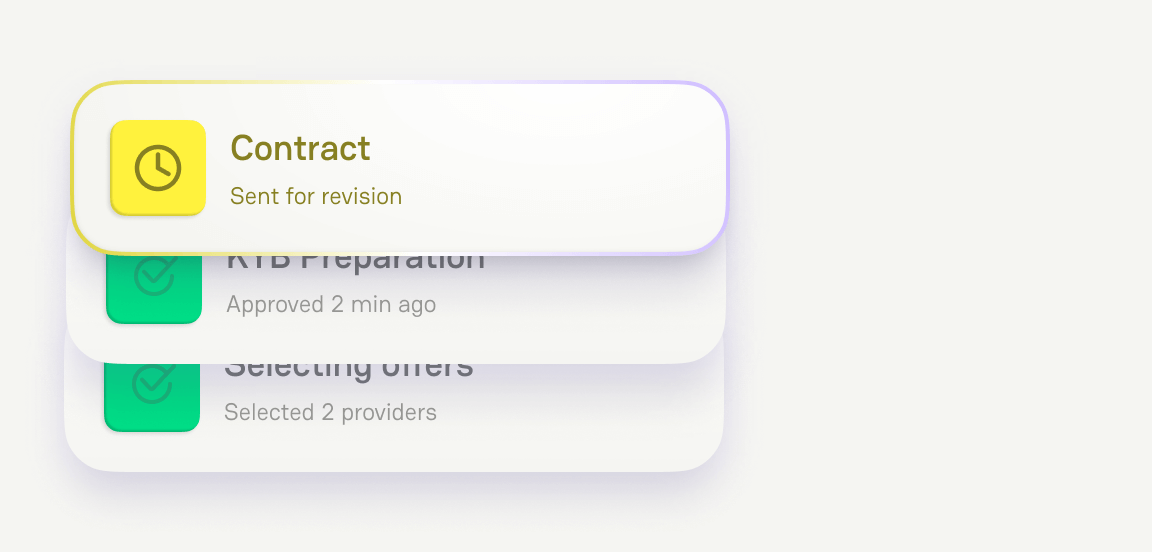

Support at every stage

No routine tasks

Get your payment solutions in 3 steps

Assist package On Request

- 1 request

- 3+ guaranteed solutions

- Negotiable rates with finding solutions

- Support in KYC process with payments providers

What’s included? The complete package

Any questions?

The flow of cooperation includes the following steps:

- Introduction meeting with the responsible manager of PayAtlas;

- Collecting the basic information about the company;

- Signing the services agreement;

- Introduction with the relevant providers.

Our consultancy services include searching for the relevant providers via our database and introducing them to the merchants. We analyse all the risk factors of the business and find the best payment options for our clients.

The merchant will get at least three introductions with the providers, one provider can offer several payment solutions to cover the priority demand of the merchant. Also, if we find more providers who are ready to move forward with you, we will set up an introduction meeting with them. In conclusion, the merchant will not get less than three payment solutions.

If for some reason you will not be able to proceed with any of the introduced providers, you can apply for the additional two providers via our database.

We are a consultancy service, therefore we do not interfere with processes such as customizing rates or collecting KYC documents, but we are open to discussing your case separately and offering additional services if needed.

For details on how this package can serve your specific needs, connect with us!

The UBO citizenship is crucial for most of the acquirers. For example, a lot of European banks can only onboard EU companies with EU UBOs. The same is true for US banks, if the company is registered in the United States then the UBO should be a US citizen as well. That is why we need to know the UBO citizenship to provide you with the providers who will be able to proceed further with the specific merchant.

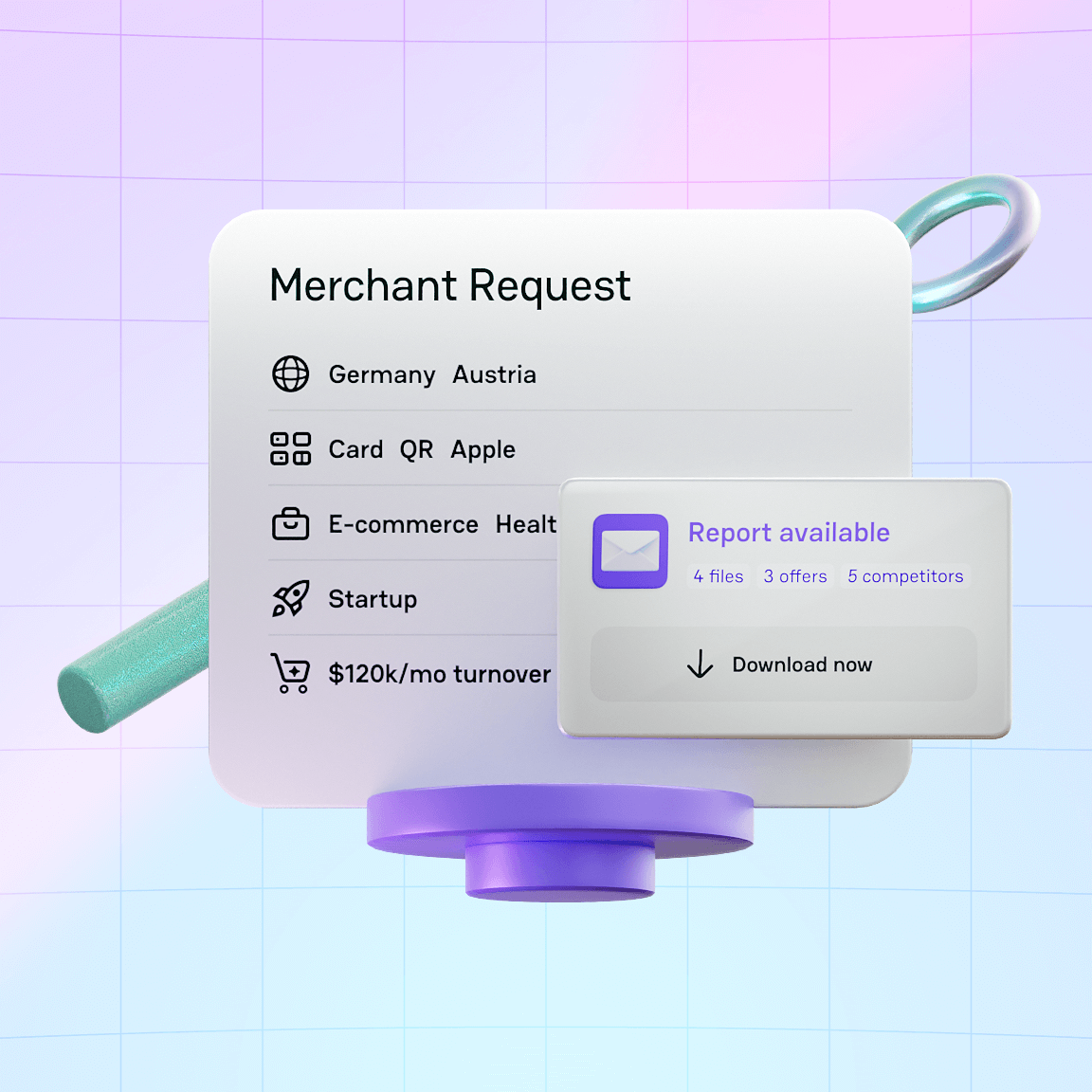

Here is the list of the main company features:

- Legal entity name

- Country of registration

- UBO citizenship

- Website

- Detailed Business Description / MCC code / Category (Industry)

- Overall monthly processing turnover, euro

- Projected 12 months transaction volume

- Projected growth rate in years 1-3

- Payment geography / Cardholder location

- Processing history period

- Fraud levels / Refund ratio / Chargebacks ratio

- Current and previous acquirers if known

- Payment methods